Global Fund

Management Platform

Artha Group is a global investment management firm focused on delivering alternative, institutionally scalable, and regulation first investment strategies across key financial jurisdictions.

Our Mission

To create long-term value by curating regulated, purpose-built investment strategies that combine innovation, insight, and integrity; empowering investors across borders.

Our Vision

To be a trusted global bridge for cross-border capital movement, enabling investors to access alternative strategies through regulated, future-ready fund platforms.

Our Core Values

Our foundational principles guide every decision and interaction, ensuring we operate with the highest standards of professionalism and integrity.

Integrity

We uphold the highest standards of transparency, ethics, and accountability in everything we do.

Innovation

We design differentiated, forward-looking strategies that adapt to evolving markets.

Governance

We embed regulatory compliance, risk management, and oversight at the heart of our platform.

Excellence

We strive for superior performance and operational discipline, creating sustainable value for our investors.

Smart Alternatives for Sustainable Growth

At Artha Bharat, we go beyond a one-size-fits-all approach. We curate distinct, purpose-built Alternative Investment Fund (AIF) strategies, each designed with a clear investment objective, rigorous risk controls, and long-term alignment with our clients' goals.

Regulated Structures

All our offerings are built within robust, globally recognized regulatory frameworks.

Risk Management & Downside Protection

Capital preservation is as important as growth, with strong controls to manage risk.

Tailored Solutions

Distinct strategies and custom mandates for HNIs, family offices, and institutions.

Governance-First Performance

Data-driven decisions and transparent processes designed to deliver sustainable alpha.

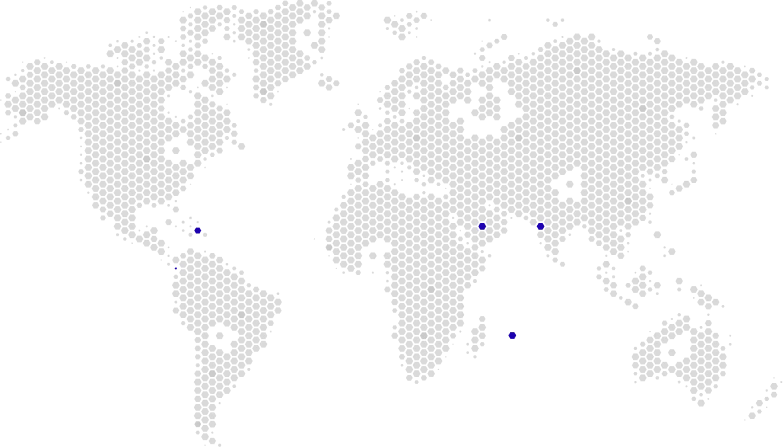

Global Presence

Artha Bharat Group is building a multi-jurisdictional investment ecosystem that connects investors across Asia, the Middle East, and global markets.

Our operational flagship, Artha Bharat Investment Managers IFSC LLP, is registered with the International Financial Services Centres Authority (IFSCA). We manage Alternative Investment Funds (AIFs) and Portfolio Management Services (PMS) strategies, with upcoming Third-Party Fund Management and Fund Distribution services pending regulatory approval.

USD 750M+ Assets Under Management (AUM)

4 International Hubs (India, Mauritius, ADGM, BVI)

Clients: HNIs, family offices, wealth platforms, and institutional investors

Get in touch

We’d love to hear from you. Whether you’re an investor, partner, or advisor, our team is here to answer your questions and explore opportunities together.

Contact us